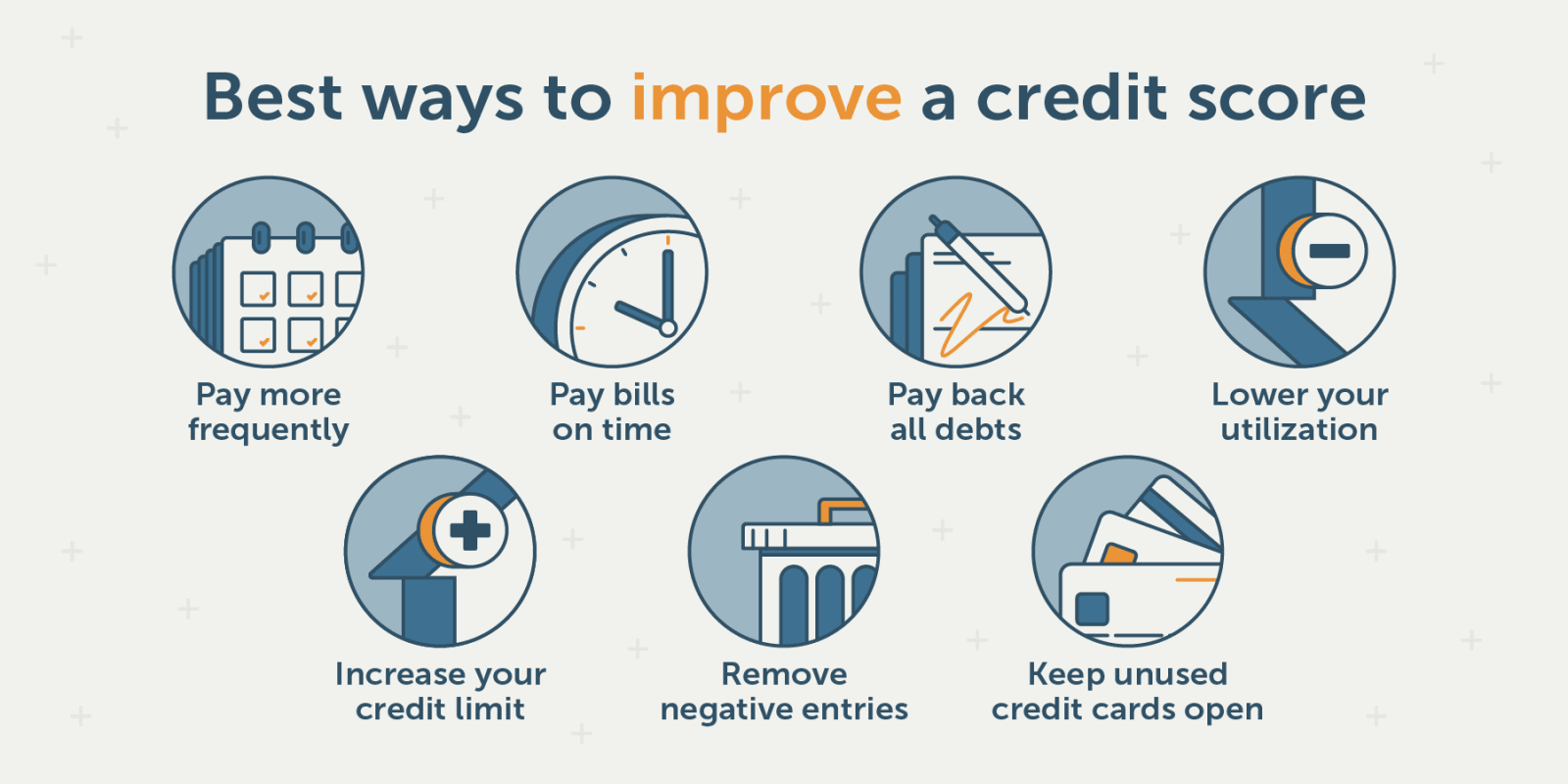

Whether you are building your credit from scratch or rebuilding after your scores have taken a hit, there are some basic steps you can take to improve your score. Make payments on time (payment history makes up the biggest chunk of your score), keep your utilization ratio low, and shop for credit only when necessary.

1. Pay Down Debt

Paying down debt is a great way to boost your credit score improvement. The amount of outstanding debt is the second most heavily weighted factor in FICO scores, and paying down balances will improve your credit utilization and reduce your total amounts owed, which are both good for your score.

However, it’s important to note that the timing of when your credit score will go up after you pay off a debt can vary depending on several factors. If you make a late payment and it ends up in collections, that can hurt your score for seven years.

Additionally, lenders like to see a diverse mix of installment loans and revolving debts in your credit report. Closing a debt and leaving only credit cards can decrease your credit mix and negatively impact your score.

2. Review Your Credit Report

A credit report is a collection of personal financial information that contains details like payment history, account balances and debts. It also lists public records such as bankruptcy filings and civil judgments. The credit bureaus Equifax, Experian and TransUnion compile credit reports for lenders.

A high credit score typically translates into lower interest rates on mortgages, auto loans and student loans. It can even help you save on life insurance. Getting your scores up to par can be done by paying bills on time, limiting credit card utilization and reducing the number of hard inquiries to your report. Taking these actions should improve your credit within a few months. However, it may take longer to get your score up to the point where lenders will view you as low risk.

3. Keep Old Accounts Open

The length of credit history and the average age of your accounts are both important factors in your score. Closing old accounts could shorten your credit history, lowering your scores.

Lenders like to see a mix of account types, including credit cards and installment loans such as student loans or mortgages. Credit mix is only a small part of your credit score, but it can help lenders assess your overall creditworthiness.

If you have an old credit card with a positive payment history that you’re not using, consider asking the account holder to add you as an authorized user. This is called credit piggybacking, and it can improve your credit scores. Just make sure the account holder reports to all three credit bureaus. Then, charge a small recurring amount each month to keep the account active.

4. Limit Hard Inquiries

Although hard inquiries only make up about 10% of your credit scores, they can still be a red flag to lenders. Having too many hard inquiries can look like you’re shopping around for lines of credit that you may not qualify for or could be unable to afford.

However, you can limit the impact of hard inquiries by applying for credit when you need it and by grouping your applications together in a short period of time. This is because most credit scoring models will treat multiple hard inquiries made for the same loan type within a short period of time as one, reducing their impact.

It’s also a good idea to check your credit report frequently for errors. If you find an illegitimate hard inquiry, you can dispute it with the creditor.

5. Make Payments on Time

It can take time to improve your credit score after making mistakes such as missing loan or credit card payments, declaring bankruptcy or having accounts sent to collections. However, there are things you can do to speed up the process.

Paying bills on time is the most important thing you can do to boost your credit score. Payment history makes up 35 percent of your credit score, and even small slip-ups can ding your scores.

To ensure that you always make your payments on time, try to charge only what you can afford to pay off by the due date and set up auto-payments if possible. Keeping a low utilization rate (the percentage of your total available credit that you have charged) and paddling out a thin credit file may also help.

Leave a Reply